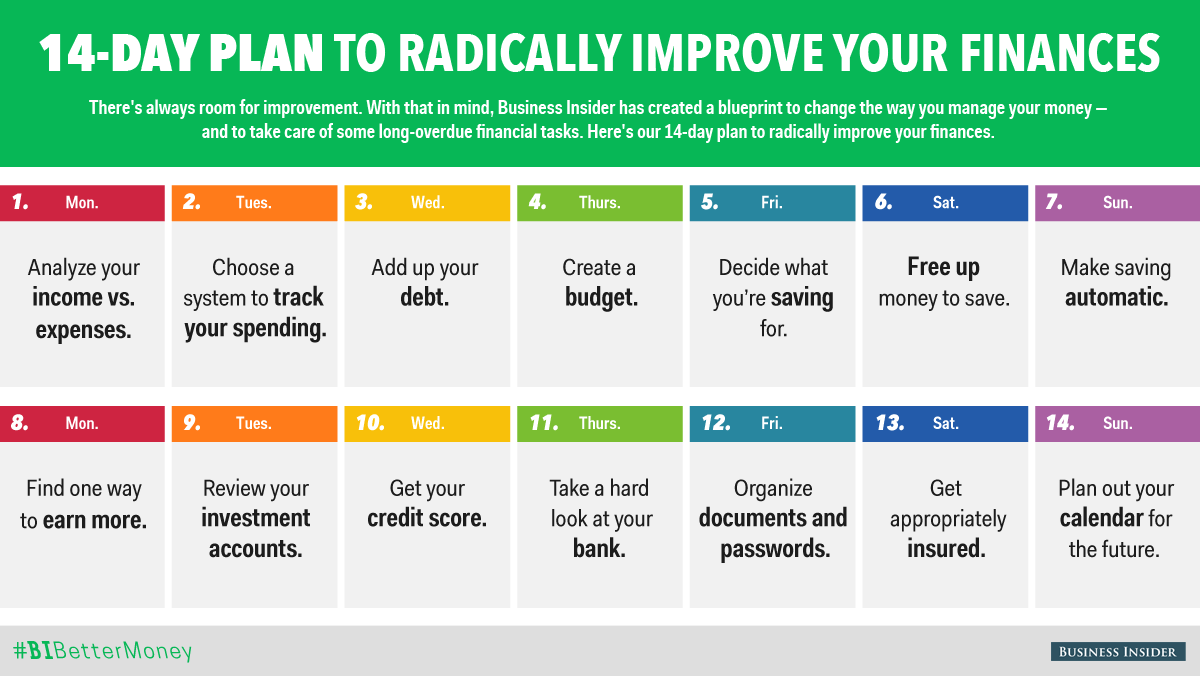

Each day is dedicated to one task, so you progress gradually learning how to manage money the right way. It starts with analyzing your income and expenses to get to know your numbers. To make managing less of a struggle, you’ll choose a tracking system during the next day. The third day is devoted facing your debt – uncomfortable, yet required since you need to pay it off. But don’t worry, creating a budget is the next beneficial step to getting rid of your debt quicker. Now it’s time to plan your savings! Firstly, decide what you are saving for, so once again, you exactly know your numbers. The following step is freeing up money for future purchases, simply put, saving it. To finish the week, you’ll learn a trick which makes saving automatic so you have less to worry about. Monday and Tuesday from the second week are devoted to making more money. Then you’ll get a credit score which gives an overview of your financial past. Choosing a bank account without unnecessary fees is what comes thereafter – another way to cut off expenses. Friday is about organizing your documents and passwords. Putting them in one place assures that you can easily keep track on them. The last weekend starts with checking whether you have a proper insurance. It’s an essential step to avoid any complications and additional expenses in case of any future accident. The 2-week course ends with planning your calendar for the future to make sure managing your financial goals becomes a new habit.